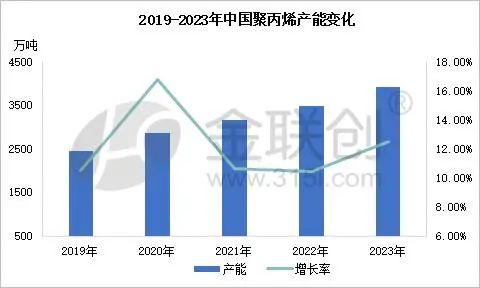

In 2023, China's polypropylene production capacity will continue to increase, with a significant increase in new production capacity, which is the highest in the past five years.

In 2023, China's polypropylene production capacity will continue to increase, with a significant increase in new production capacity. According to the data, as of October 2023, China has added 4.4 million tons of polypropylene production capacity, which is the highest in the past five years. Currently, China's total polypropylene production capacity has reached 39.24 million tons. The average growth rate of China's polypropylene production capacity from 2019 to 2023 was 12.17%, and the growth rate of China's polypropylene production capacity in 2023 was 12.53%, slightly higher than the average level. According to the data, there are still nearly 1 million tons of new production capacity planned to be put into operation from November to December, and it is expected that China's total polypropylene production capacity is expected to exceed 40 million tons by 2023.

In 2023, China's polypropylene production capacity is divided into seven major regions by region: North China, Northeast China, East China, South China, Central China, Southwest China, and Northwest China. From 2019 to 2023, it can be seen from the changes in the proportion of regions that the new production capacity is directed towards the main consumption areas, while the proportion of the traditional main output area in the northwest region is gradually decreasing. The northwest region has significantly reduced its production capacity from 35% to 24%. Although the proportion of production capacity is currently ranked first, in recent years, there have been fewer new production capacity in the northwest region, and there will be fewer production units in the future. In the future, the proportion of the northwest region will gradually decrease, and the main consumer regions may jump up. The newly added production capacity in recent years is mainly concentrated in South China, North China, and East China. The proportion of South China has increased from 19% to 22%. The region has added polypropylene units such as Zhongjing Petrochemical, Juzhengyuan, Guangdong Petrochemical, and Hainan Ethylene, which has increased the proportion of this region. The proportion of East China has increased from 19% to 22%, with the addition of polypropylene units such as Donghua Energy, Zhenhai Expansion, and Jinfa Technology. The proportion of North China has increased from 10% to 15%, and the region has added polypropylene units such as Jinneng Technology, Luqing Petrochemical, Tianjin Bohai Chemical, Zhonghua Hongrun, and Jingbo Polyolefin. The proportion of Northeast China has increased from 10% to 11%, and the region has added polypropylene units from Haiguo Longyou, Liaoyang Petrochemical, and Daqing Haiding Petrochemical. The proportion of central and southwestern China has not changed much, and there are currently no new devices put into operation in the region.

In the future, the proportion of polypropylene regions will gradually tend to be the main consumer areas. East China, South China, and North China are the main consumer areas for plastics, and some regions have superior geographical locations that are conducive to resource circulation. As domestic production capacity increases and supply pressure highlights, some production enterprises can leverage their advantageous geographical location to expand overseas business. In order to comply with the development trend of the polypropylene industry, the proportion of the northwest and northeast regions may be decreasing year by year.

Post time: Nov-20-2023